Buildings that are used with the sole purpose of approved business or expansion project as a BioNexus Company will get an industrial building allowance of 10 for a period of 10 years. Malaysia has agreed in principle to implement global minimum tax of 15 on certain multinational companies MNCs said Inland Revenue Board IRB chief executive officer CEO Datuk Mohd Nizom SairiHe said Malaysia was among 136 countires announced by the Organisation for Economic Co-operation and Development OECD.

Asiapedia Iras 2017 Singapore Personal Income Tax Dezan Shira Associates

The existing standard rate for GST effective from 1 April 2015 is 6.

. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. But the process of implementing the new tax regime commenced a long time ago. For instance a manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 72 as only 30 of.

Tax Rate of Company. Company Taxpayer Responsibilities. This page provides - India Corporate Tax Rate - actual values historical data forecast chart statistics economic.

Year Assessment 2017 - 2018. On July 1st 2017 the Goods and Services Tax implemented in India. Company with paid up capital more than RM25 million.

Corporate Tax Rate in India remained unchanged at 2517 percent in 2021 from 2517 percent in 2020. For example if you take up a job while overseas and you only receive the payment for the job when you are back in Malaysia. This is applicable on payments made to residents of all the treaty partners listed except for certain countries including Germany Turkmenistan Bosnia and Herzegovina Senegal and Jordan where the respective tax treaties have provided for such type of income to be taxed only in the contracting state in which the.

A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia. Malaysia follows a progressive tax rate from 0 to 28. Corporate Tax Rate in the United States remained unchanged at 21 percent in 2021 from 21 percent in 2020.

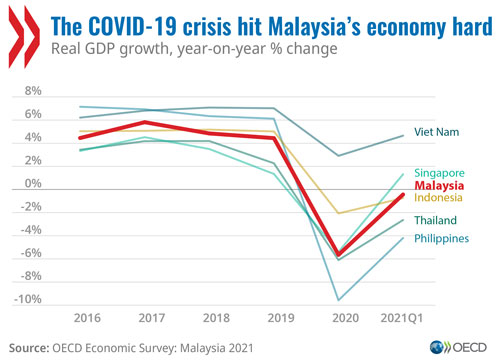

GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. Gross domestic product GDP of Malaysia grew 444 percent in 2019 and was forecast to remain around 5 percent for the medium term.

PUTRAJAYA Aug 1. Corporate Tax Rate in India averaged 3375 percent from 1997 until 2021 reaching an all time high of 3895 percent in 2001 and a record low of 2517 percent in 2019. Tax Rate of Company.

Company with paid up capital not more than RM25 million. 24 Year Assessment 2016. In 2000 Atal Bihari Vajpayee then Prime Minister of India set up a committee to draft the GST law.

Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax. Corporate Tax Rate in the United States averaged 3237 percent from 1909 until 2021 reaching an all time high of 5280 percent in 1968 and a record low of 1 percent in 1910. Company with paid up capital not.

The tax rate is concessional at 20 of the statutory income derived for businesses that are approved after the tax exempt period is expired up to a period of 10 years. Although Malaysia is neither a tax haven nor a low tax jurisdiction for companies which are eligible for the tax incentives the effective tax rates may be significantly below the normal corporate tax rate of 24. This page provides - United States Corporate Tax Rate - actual values historical data forecast.

While Budget 2022 had announced. The rate of WHT on such income is 10. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields.

The Goods and Services Tax GST is an abolished value-added tax in Malaysia. There are no other local state or provincial. An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality.

In 2004 a task force concluded that the new tax structure should put in place to enhance the tax regime at the. No other taxes are imposed on income from petroleum operations.

Corporation Tax Europe 2021 Statista

Income Tax Malaysia 2018 Mypf My

Income Tax Malaysia 2018 Mypf My

Malaysia Further Reforms To Boost Business Dynamism Would Strengthen The Recovery From Covid 19 Says Oecd

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Corporation Tax Europe 2021 Statista

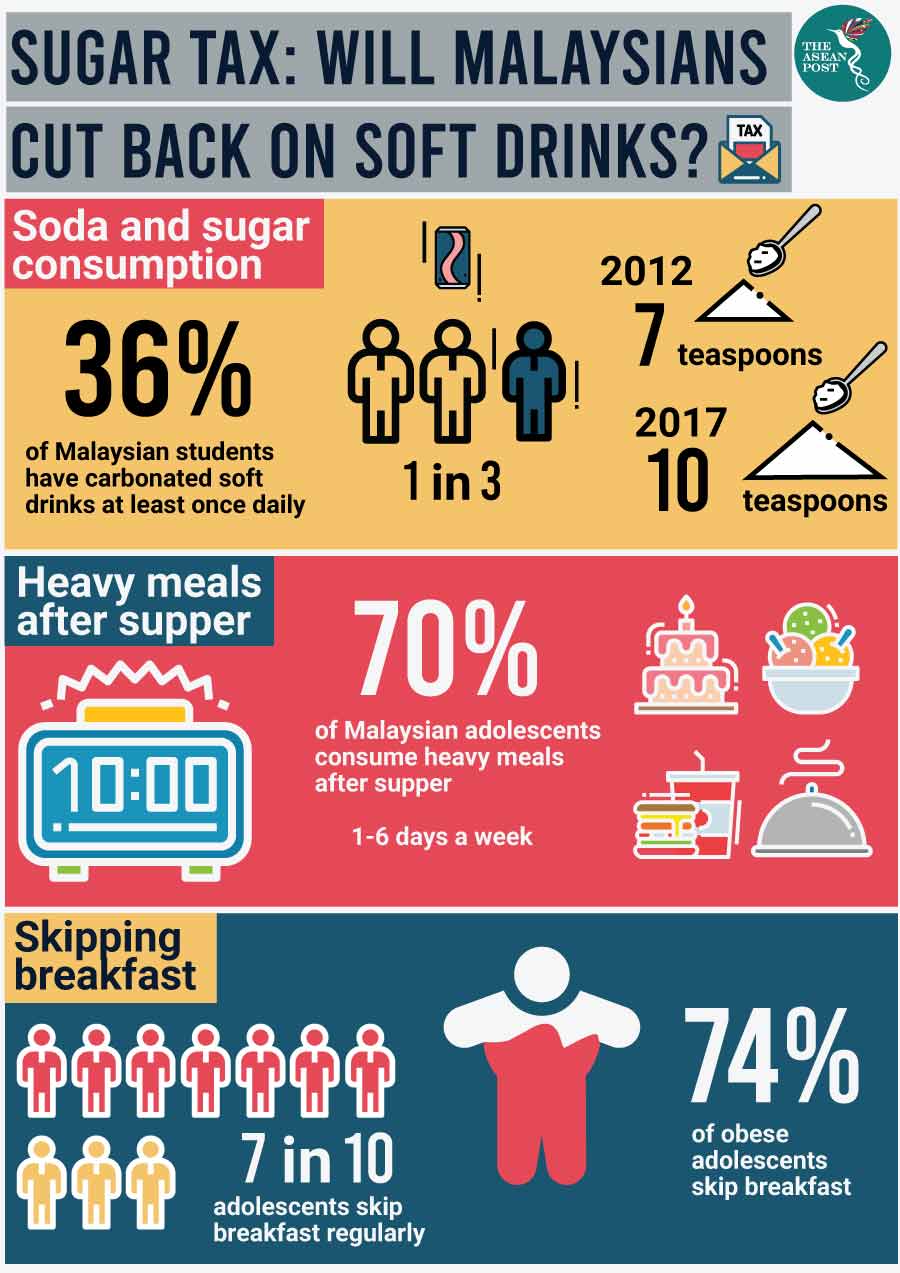

Malaysian Teens Are Overweight The Asean Post

Beauty Personal Care Sales Channels Malaysia 2024 Statista

Malaysia Payroll And Tax Activpayroll

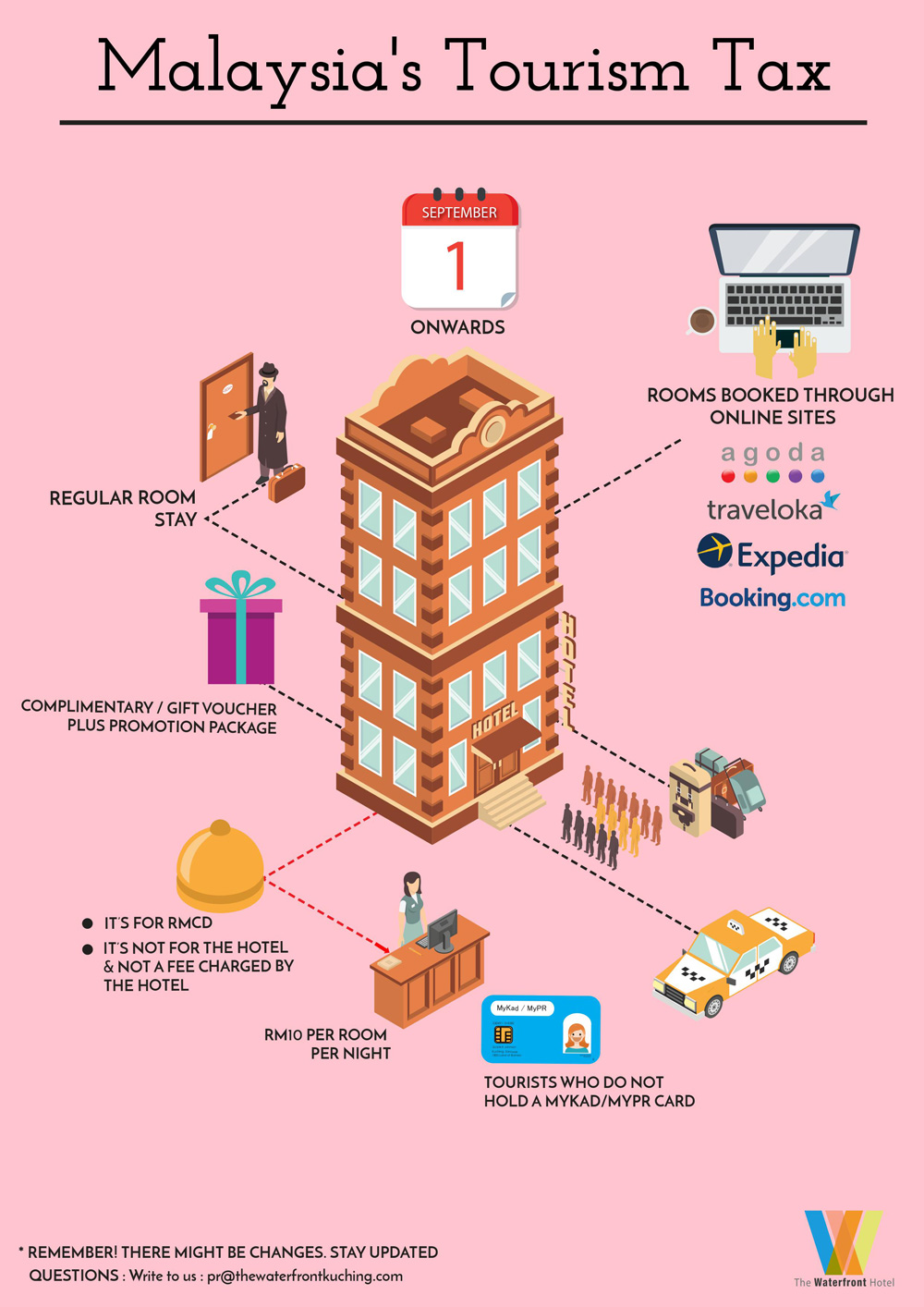

Malaysian Tourism Tax The Waterfront Hotel

Lung Cancer In Malaysia Journal Of Thoracic Oncology

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Malaysian Personal Income Tax Pit 1 Asean Business News

Individual Income Tax In Malaysia For Expatriates

Mobility Basics What Are Tax Equalisation And Tax Protection Eca International

Which U S Companies Have The Most Tax Havens Infographic

Doing Business In The United States Federal Tax Issues Pwc